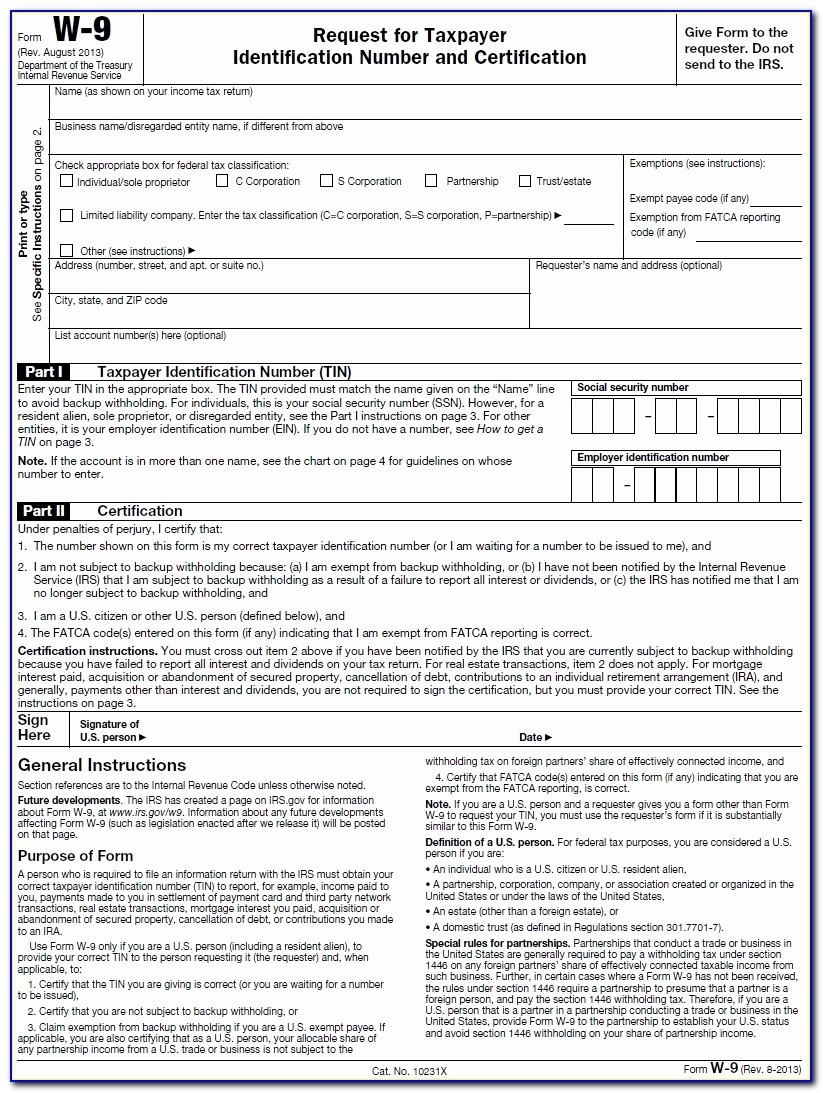

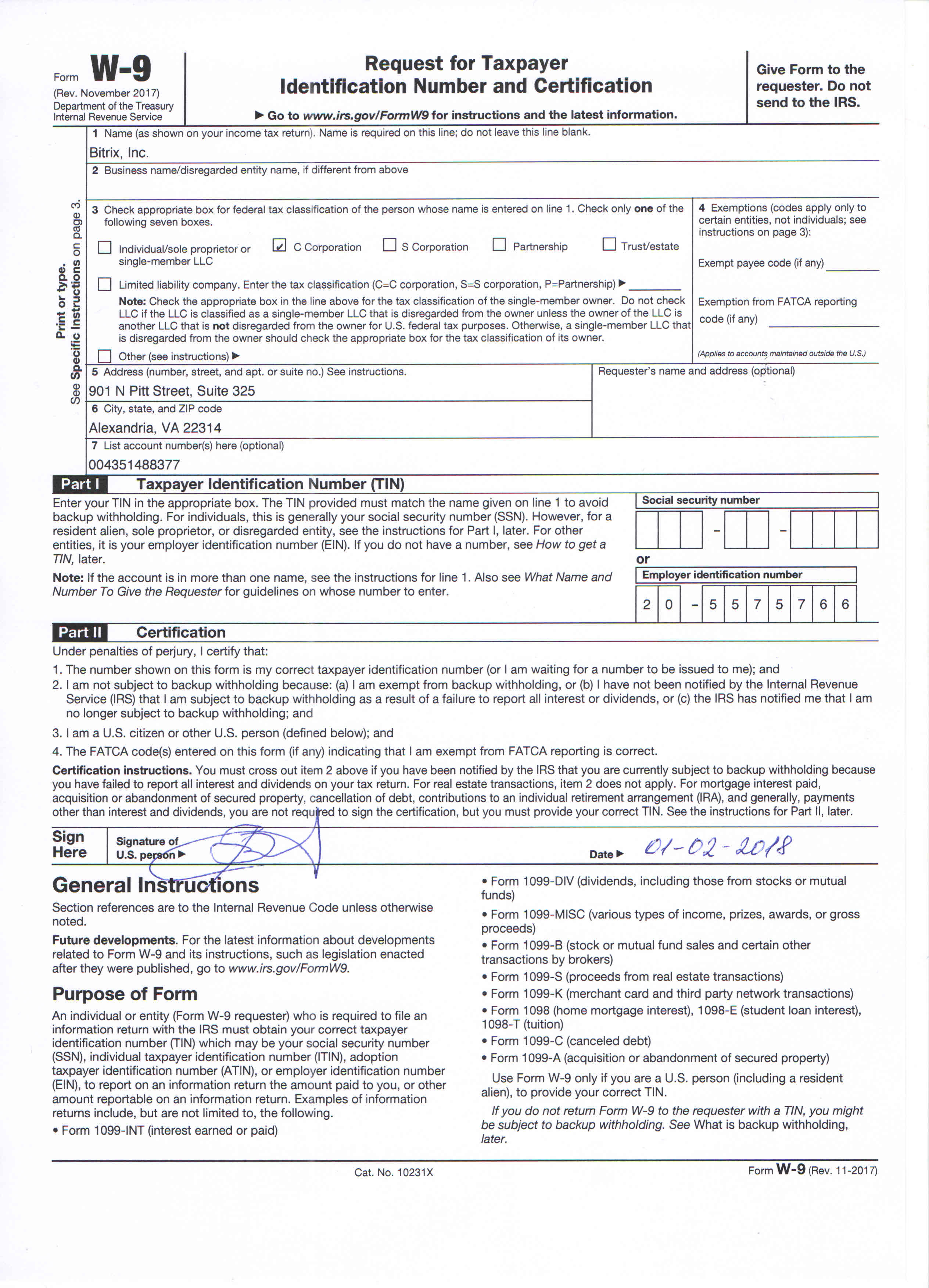

On the other hand, W-9 form 2022 is usually requested by payers. Whenever a payee provides a valuable service or sells a good in exchange for money, they should be ready to complete a W-9 including the most recent transactions. You can put in the data manually and print it directly from the website. Do not forget to make a backup and archive it until any potential emergency.Īn editable IRS W-9 form also exists. After completing the process, send it to the client or employer as soon as possible for safekeeping. You only need to download it and proceed with filling in relevant information as instructed by the document itself. The IRS federal website has all forms in PDF. The government does not tolerate such mistakes on the part of the taxpayer.

Providing correct TIN is crucial since errors and incomplete information can be used as a base for fees and other penalties.

0 kommentar(er)

0 kommentar(er)